Fora Financial, a small business lender, announced a new securitization for $127M.

The transaction’s structure, including overcollateralization and excess spread for additional protection.

Quick overview of Fora Financial:

– Founded in 2008 by Jared Feldman and Daniel Smith

– Provides financing to small and medium-sized businesses

– Has funded over $4.0 billion to more than 35,000 Merchants

– Recently announced a $127.0 million securitization (FFAS 2024-1) backed by small business loans and merchant cash advances

Products:

1. Advance Receivables: Purchase of future receivables, not loans

– Daily or weekly remittances

– No fixed term, estimated collection period of 3-24 months

– Priced using a factor rate (RTR ratio)

2. Business Loans: Fixed-term loans up to 18 months

– Daily or weekly payments

– Fixed fee instead of interest rate

– Personal guarantee required

Underwriting Policy:

– Uses proprietary PRISM scoring model

– Considers 200+ data points from sources like Experian and LexisNexis

– Minimum criteria: 500 FICO, 6 months in business, $1,000 avg daily bank balance

– Manual adjustments possible for lower Credit Tiers

– Any application with PRISM score > 20 is declined.

Here’s how PRISM score is used across tiers.

– Tier 1: 0 – 4.99

– Tier 2: 5 – 9.9

– Tier 3: 10 – 14.99

– Tier 4: 15 – 19.99

– Tier 5: 20 – 24.99

– Tier 6: 25+

Portfolio:

The $132.4 million collateral pool consists of 2,326 receivables to 2,281 unique merchants.

Key metrics:

– Total receivables: 2,326

– Wtd avg RTR ratio: 1.34x

– Wtd avg FICO: 692

– Avg outstanding receivables balance: $56,925

– Wtd avg original term: 13.6 months

– Wtd avg remaining term: 9.2 months

– Top states: CA (13.86%), FL (10.20%), TX (9.92%)

Fora doesn’t charge based on traditional interest rate metrics. Instead, it uses a concept called “Calculated Receivables Yield” for pricing.

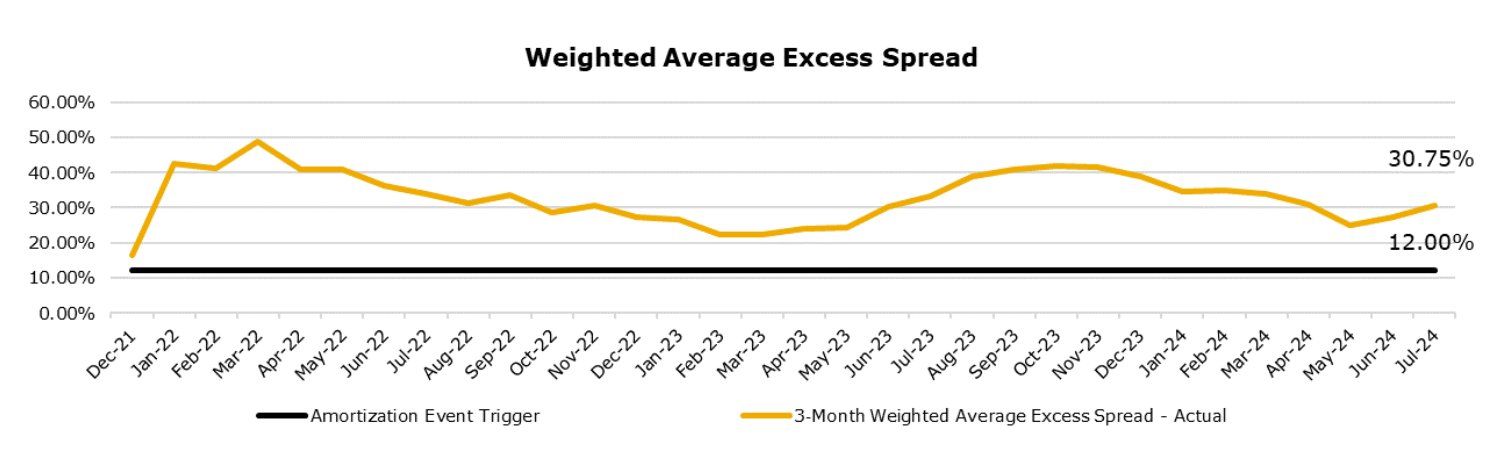

The weighted average excess spread is 30.75%.

This yield is calculated using:

– The expected collection period

– The funded amount

– The RTR (Return to Receivable) Amount

– Assuming no prepayments or defaults

– Assuming monthly scheduled payments are received at an 80% Performance Ratio

The weighted average Calculated Receivables Yield at origination for the Statistical Pool is 44.77%.

The receivables are to small businesses across various industries.

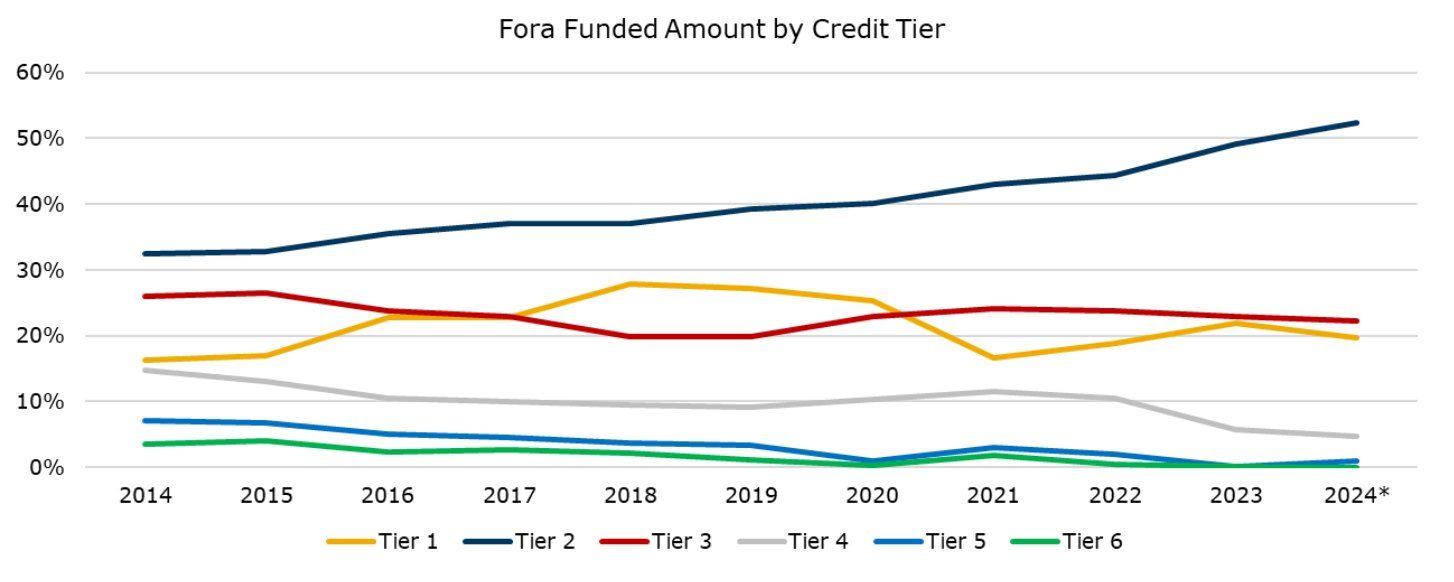

Distribution by Credit Tier:

– Tier 1: 22.53%

– Tier 2: 57.08%

– Tier 3: 18.16%

– Tier 4: 2.23%

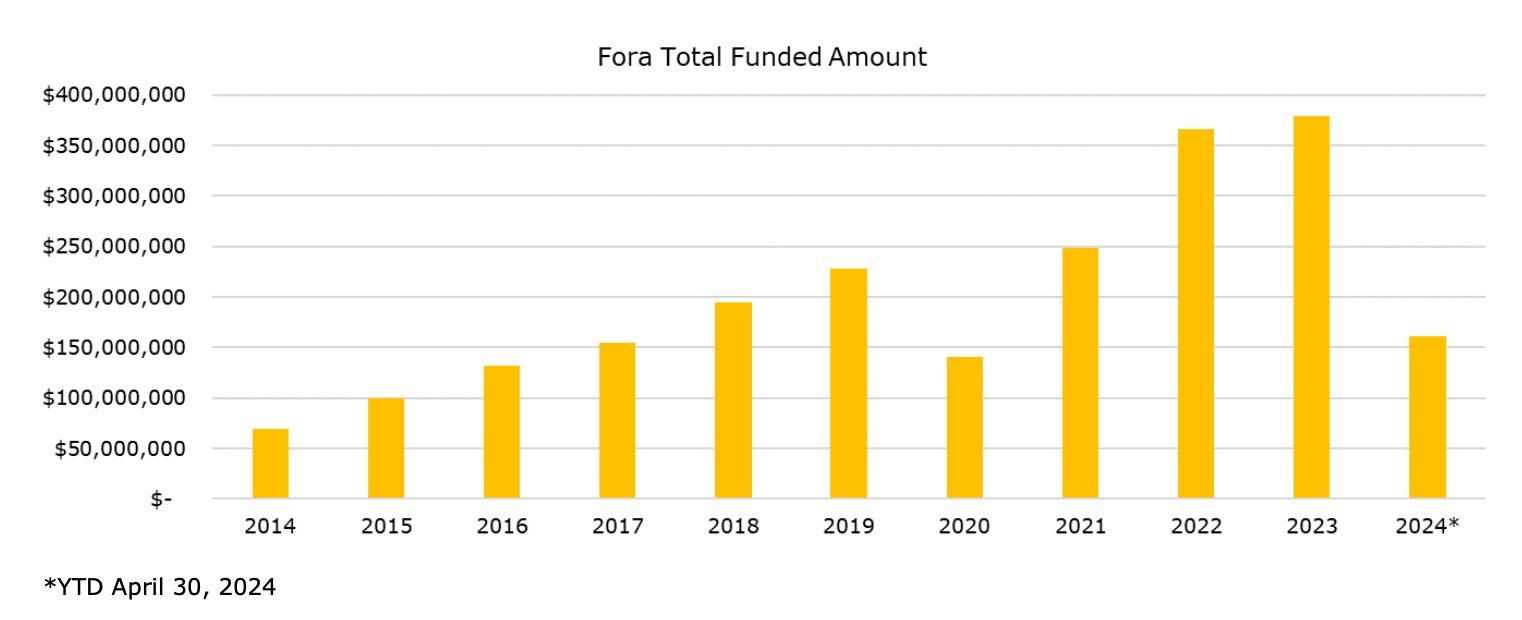

Growth:

Fora’s originations have grown from ~$60 million in 2021 to $379 million in 2023.

Product type breakdown:

– Advance Receivables: 56.64%

– Business Loans: 43.36%

Servicing and Collections:

– Fora Financial Servicing LLC as the primary servicer

– Orion First Financial, LLC as backup servicer

– Collections primarily via ACH debits

– Servicing fee is not known but generally, it’s 2%-4%

The transaction features a 24-month revolving period and includes various rapid amortization triggers to protect investors.